By William Atkins

Put simply, a span of control is the number of employees a manager directly supervises.

Reality makes things more complex, though, particularly when that manager’s responsibilities span different functional areas and time zones. A CFO is often responsible for more than just finance, and in my career, I’ve had the full spectrum of G&A functions roll up to me, including Corporate Development/M&A, Legal, IT, HR, and Facilities. Nevertheless, the same broad lessons apply, regardless of whether the CFO’s remit is finance or includes other areas as well.

In a global context, spans of control increase in complexity. Enterprise-level organizations deploy large teams across multiple geographies, languages, and cultures. Communication across time zones requires a combination of flexibility (e.g., calls and meetings during non-working hours) and consistency (e.g., regular, consistent interactions with international and domestic colleagues). In common with his or her C-Suite peers, a CFO needs enhanced processes and tools to ensure strong communication, productivity, and results.

When building or transforming a global organization, I have two guiding principles:

- Save live interactions for higher-level discussions or interpersonal discussions. While regular, no-agenda check-ins are always necessary; it’s advisable only to have set-piece meetings that require multiple inputs and that deeply impact the most people. Do not use meetings for data exchange, which should happen via asynchronous means.

- Ensure that some form of matrix management exists for clear communication to facilitate regular buy-in and information exchange with non-finance colleagues. This is counterintuitive, particularly for a discipline like finance where clear lines of authority are essential, but international spans of control require a lot more cross-functional collaboration.

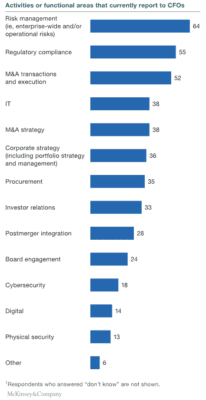

Finance is a big tent, generally including areas previously considered adjacent to the finance function. On average, five functions other than what could narrowly be defined as finance now report to the CFO. For example, more than half of CFOs surveyed by McKinsey say that risk, regulatory compliance, and M&A report directly to them.

CFOs are tasked to drive expertise in strategic decision-making well beyond the traditional confines of financial reporting. Today’s CFO must consider an abundance of data, predictive analytics, and superior levels of financial intelligence that far surpass the situation of even just a few years ago. The approaches outlined below help a CFO manage internationally and have situational awareness outside the sole confines of finance.

Actionable ways to successfully manage international spans of control

For a globally-minded CFO, there can be no divide between the domestic business and the rest of the world. Every person and every number is equally important.

When used wisely, these improved processes and tools make managing international spans of control much easier and more efficient.

#1. Use asynchronous, centralized information exchange to eliminate clutter.

It’s remarkable how difficult it can be to transfer relatively standardized information – even in large, sophisticated organizations. This problem gets worse when international jurisdictions are involved.

For example, a company I was recently involved with used a third party to manage a critical warehouse in our supply chain – one that was located in a different country and time zone. Their systems and processes were incompatible with ours, and data transfer — whether via EDI or email attachments — was problematic. This caused frequent, contentious discussions both internally and with the vendor and rightly drew our auditors’ attention to a possible control deficiency.

The company created a process with extremely strict access controls so that its products could be scanned into the ERP system directly from the warehouse. Within days, the noise had gone out of the system: Employees could log into the ERP at any time and see exactly what the underlying activity was. Company records were up-to-date and transparent, and interactions were less frequent, more pleasant, and focused on higher-level matters.

#2. Embrace lateral communication.

Matrix management works — as long as clear lines of accountability are maintained. A country CFO or divisional Controller should always have a solid reporting lineup through finance. Still, they should also have a dotted line to the relevant operating executive in charge of their particular country or division.

My conversations with these non-finance executives give me insights into how my finance team interacts with their operating colleagues and, as importantly, how my finance colleagues are doing from an HR standpoint. These regular check-ins have often given me insights into the business that I haven’t gotten from within finance. I’ve tapped into organizational issues and have been able to mitigate them before they’ve become major challenges. For example, via my check-ins with these non-finance counterparts, I’ve caught early sight of country-specific sales initiatives that have either required some tweaking of finance processes or that have needed tweaks themselves. I’ve also been made aware of morale issues within my own offshore teams that I otherwise wouldn’t have known about.

Having another pair of boots on the ground is always helpful when operating in international environments.

#3. Eliminate any functional divisions between domestic and international teams.

The existence of roles such as “International Controller” or “International FP&A Head” often promotes disjointedness throughout the organization and, in some circumstances, a lack of ownership and responsibility. As a general rule, I aim to lead a finance organization without international silos at the senior level. For example, the person responsible for Revenue Accounting should be responsible for Revenue Accounting worldwide and with specific country and or functional roles allocated below them.

Higher-level finance managers are responsible for understanding all aspects of their jobs, including any differences between how those jobs are performed in the USA and other jurisdictions.

#4. Email is not a conversational tool; use the phone instead.

Email is a great tool for asynchronous communication. In fact, within an international organization, my operating assumption is that email is always asynchronous. The scope for wasted time and misunderstandings increases dramatically when operating across time zones and cultures. It gets worse when there’s no genuine interaction and when people retreat into email exchange as their only tool for communication. The solution? Pick up the phone.

I remember a US-based senior colleague who made a point of regularly calling into our European offices while driving to work. And he would call into our Asian offices on his way home or after dinner. This didn’t happen every day or always with the same people, but he connected consistently with people in real time. As a result, he was the best-informed person in the office about what was happening in his organization — globally. His people also knew him better as a person and had a stronger worldwide esprit-de-corps than in other parts of the company. I learned a lot by watching how he managed his team.

#5. Strong communication drives global business objectives.

While global CFO responsibilities continue to increase, it’s critical to add another: effective internal communications. Successful multinational management and leadership around international spans of control, particularly from the office of the CFO, demand strong communication processes.

Extensive email chains, superfluous meetings, and inefficient reporting structures only serve to broaden silos, break down trust, and wreak havoc on output. Be disciplined at maintaining a strong global presence and set expectations around ways of working so you and your team can focus on driving financial objectives.

For additional FLG Partner commentary about international spans of control, please watch our recent video featuring author William Atkins: Lessons Learned by a Technology CFO, or connect with FLG Partners for a complimentary consultation.