By Kenton Chow

Customers demand seamless, efficient, personalized experiences delivered in real time. Countless organizations accelerated their shift to digital channels during the pandemic, and these behaviors have now become customers’ new expectations.

While most organizations understand the importance of digital transformation for customer success, how well organizations capture data and deliver customer insights and experience is key to greater profitability and customer satisfaction.

Companies are focused on the insights derived from AI-based, predictive analytics as a guide. There is a lot of buzz about data and insights in all industries, but why?

Raw data can provide some perspective and insights but not the difference-making outcomes between leading and lagging. The goal is to deliver domain-specific data-driven analytics solutions that generate higher-level outcomes and give customers a critical edge in competitive industries.

What is Predictive Analytics?

Predictive analytics is a process that uses data to predict future outcomes. It uses a combination of statistical models, machine learning, artificial intelligence, and data analysis to find patterns in data that can predict future behavior. The goal is to go beyond knowing what has happened to provide a better assessment of what will happen in the future.

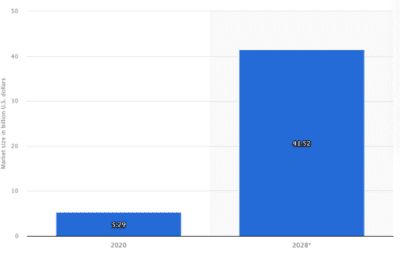

This trend in predictive analytics is big business. The market for predictive analytics software was valued at 5.3 billion U.S. dollars in 2020 and is forecasted to grow to 41.5 billion U.S. dollars by 2028.

Global predictive analytics market revenue worldwide in 2020 and 2028 (in billion U.S. dollars).

Source: Statista

What to do with Predictive Analytics output?

Businesses must adapt quickly, form instantaneous connections with consumers, and predict the next move before it’s too late. In this fast-moving marketplace, real-time data, powerful analytics, and the technology infrastructure to turn insights into action are the difference between those who thrive and those who are left behind.

Without the right questions, approaches, and technology, data can provide some insights but not the outcomes that differentiate leading from lagging.

Here are some examples of how predictive analytics is impacting business today:

Personalize Customer Experiences

Customer personalization is a key differentiator in today’s world where businesses must settle consumer requests in seconds, deliver hyper-personalized customer experiences at scale, and rapidly shift their business strategy in response to market changes.

For example, when I worked as the CFO of Wine.com nearly 15 years ago, our team analyzed a steady stream of web traffic and shopping data in order to design curated wine offerings and personalized marketing promotions based on customer demographics, vintage preferences, and buying patterns.

We used predictive analytics models to derive insights based on where shoppers are drawn to on a page, what they click, the site flows that lead to transactions, and the flows that lead to customers clicking away. This resulted in optimizing the customer experience, and we were able to help the company generate significant, incremental sales.

Today, AI-based tools curate personalized offerings that are far more sophisticated. Amazon, for example, has evolved data analytics into science to address the rapid change in customer expectations that has morphed into the always-on, immediate gratification world of digital customer engagement.

Personalization is the key differentiator in today’s world where businesses need to be able to settle consumer issues in seconds, deliver hyper-personalized customer experiences at scale, and rapidly shift their business strategy in response to market changes. The ability to make better, faster decisions has become a real challenge.

Optimize to Reduce Inefficiency

However, even though data is the key to better business decisions, enabling companies to predict trends, deliver better customer experiences, and streamline workflows, many companies struggle to use data effectively. This is more than just having access to data or using analytics as part of the strategic decision-making process. True data leaders in the current environment are achieving solid consistency of data. They can access and deliver real-time data and insights at multiple points in the overall workflow so that all parts of the organization work from the same playbook. They also house that data in the cloud to be leveraged across their organizations.

The insurance industry, for example, uses predictive analytics to improve the efficiency of claims processing.

Property and casualty (P&C) customers have increasingly migrated to digital, self-service channels to manage claims, shop for new coverage, and resolve questions. Customers are finding that insurer websites and apps are not up to the task. According to Tom Super, head of P&C insurance intelligence at J.D. Power,

“The bar just continues to get higher for customer expectations around digital, and while many insurers are hitting the mark on the basics, few insurers are using digital in new ways to drive growth and engagement. Customers’ pace of expected change is accelerating, and insurers must be able to take steps to go beyond the basics of simply digitizing customer tasks. Those that can make this leap will be poised to separate themselves from the pack.”

The example illustrates a trend that is cutting across virtually every industry. In a world where an insurance claim can be settled in three seconds, a consultation with your physician can happen in your living room. Payments can be transmitted and processed seamlessly using nothing more than a thumbprint on your phone; it is simply no longer acceptable to have to fill out redundant forms, sit on hold for customer support, or wait… for anything.

Enhance Visibility and Predictability

Visibility and Predictability are often a challenge for the C-suite. One practical application of predictive analytics focuses on a better understanding of the use of capital and cash needs across the business and how to optimize the allocation of this capital continually. Utilizing data-driven, predictive analytics models is a critical capability for finance organizations to integrate machine learning and AI-based analytics to develop new data and scenario-driven statistical forecast models.

Agile planning, short-term capital allocation, and predictive forecast models collectively foster a more resilient business that can improve business and finance performance, resulting in a sustainable competitive advantage and improved profitability.

These examples and countless more have made predictive analytics a critical success factor for C-suite executives. Thanks to the last several years of innovation, customer perceptions of quality have become inextricably linked to speed and ease of use. Increasingly, businesses’ ability to meet and exceed that expectation will define winners and losers.