By Greg Curhan

Raising money in the capital markets for a biopharma or life sciences company over the last few years has been quite a roller coaster ride.

Funding among U.S. biotech startups reached a record high of $77 billion in 2021 (Crunchbase), as investors were attracted to expanding opportunities in genetics, therapeutics and diagnostics. In 2020 and 2021, an all-time high of nearly $105 billion was invested in private life sciences companies and IPOs with valuations peaking in early 2021 as COVID-19 vaccines and drugs helped navigate the country out of the acute phase of the pandemic.

But post-pandemic, the picture has changed dramatically. Investors moved on to other sectors as the economic recovery got underway, then supply chain aftershocks, inflation and a fast rise in interest rates have more recently sent stock prices plunging downward with biotech valuations plummeting more than the broader averages. Roughly a quarter of all public biotechs are now trading below the value of their cash reserves, according to Mizuho Securities which predicts that anywhere from a quarter to a third of all publicly traded biotechs need to “go away,” via delisting, reverse mergers or acquisitions, before the sector reaches a “fundamental point of normalization.”

Post-Pandemic Capital Market Trends in Life Sciences

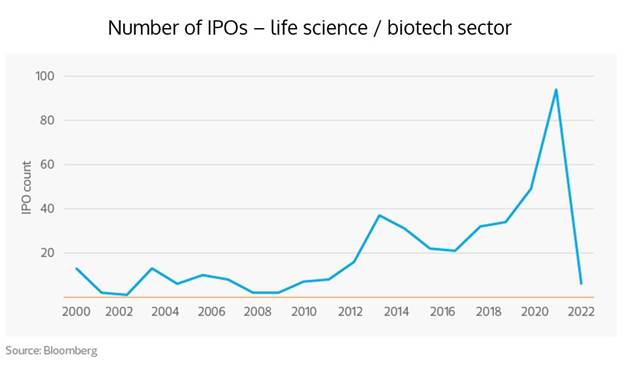

As valuations have declined, the IPO as a vehicle for raising capital at life sciences companies has nosedived. According to Bloomberg, CBE and Silicon Valley Bank analyses, the pace of Life Sciences IPOs in 2022 (Q1-Q2) is trending well below the previous three years and the average size of biotech IPOs is also declining.

Equity venture funding in Life Sciences has also declined precipitously through Q3 2022 as investors see more limited upside in life science investments with a need to reserve a significant portion of their capital to invest in existing portfolio companies.

Source: Silicon Valley Bank, October 2022 (preliminary Q3 data)

As we approach 2023, cash is now king again as CEOs look to scrutinize use of scarce capital and liquidity and plan to finance their growth as private companies over a much longer time horizon.

So how CAN life sciences companies successfully finance growth in 2022-2023 with a weak IPO market and a diminishing pool of venture-based equity financing?

Both private and public companies can still look to sources of capital in the debt markets. Some will be able to use capital equipment loans if they are investing in infrastructure for testing and manufacturing. Others who are further downstream in the drug discovery pipeline (in clinical trials) may even be able to monetize royalty streams. But a broader array of life sciences companies will potentially qualify for venture loans.

Venture Loans as a Source of Capital for Life Sciences Companies

Venture loans in life sciences are different from many other forms of debt in that venture lenders do not typically lend based on future cash flows at a company. Instead, they lend against their assessment of the potential success of a company’s product portfolio and the likelihood that existing equity investors will continue to reinvest over time, thereby lowering the potential for default on the venture loan. Venture lenders will carefully examine who equity investors are, how much they have invested to date, the robustness of the product pipeline at the company, the stage of development of the company (preclinical, in clinical trials stage I, II or III, applying for new drug application) and the amount of cash on hand vs the projected need for capital over the product development horizon in that life sciences biotech niche. All of these factors will be used by the lender to determine both the size and terms of the venture loan.

What Matters in Venture Debt Negotiations?

When a life sciences company is negotiating a loan with a venture lender, there are a number of key terms which matter:

- Commitment Amount – This is the total size of the facility. It is often broken up into tranches with borrowers able to access increasing amounts of loan proceeds as they achieve key scientific, regulatory or financial milestones.

- Interest Rate – This is normally a floating rate expressed as WSJ Prime plus a percentage. This often comes with a floor. It is possible in some instances to get a fixed rate.

- Repayment Schedule – The loans will amortize similar to a mortgage with interest and principal being repaid until the loan is mature. There will often be an “interest-only” period where no principal payments are being made.

- Facility Fee – This is an upfront fee at the time of loan closing that can either be assessed on the entire Commitment Amount or only on tranches as they qualify.

- Final Payment – There is often a fee at the point the loan matures or is terminated. Most often based on the advance amount.

- Warrants or Success Fee – Venture lenders are a cross between traditional debt providers and venture capitalists. They are comfortable taking more risk with early-stage companies than a traditional lender, but in return require a higher return than a lender, but because of their seniority in the cap structure, not as much as a venture capitalist. Term sheets will usually require an equity component in the form of warrants. In some instances, lenders will agree to forego warrants for a Success Fee. This fee is expressed as a % of the Advanced amount and can be triggered by an IPO or Change of Control.

- Financial Covenants – These are variable but can include minimum cash balances, achievement of forecasted revenue, expense, etc.

So as a CEO or CFO, what should you negotiate for (best case) and what should you watch out for?

- Commitment Amount – Make sure the amount will allow you to get to significant value inflection milestones. Also, tranches “at the discretion of the lender” aren’t really of any value. The tranche qualifiers should be SMART – Specific, Measurable, Achievable, Relevant, and Time bound.

- Interest Rate – These are generally market based and tend not to vary much between lenders. If you have the option of choosing a fixed rate, which can be appealing in a rising interest environment, make sure to model out the cash flows, as the bank may set the fixed rate high enough to mitigate their risk, but it may actually make more sense for you as the borrower to take on that risk

- Repayment Schedule – A venture loan is only good if you can actually use the proceeds to grow your business. If the interest-only period is too short, you end up repaying the loan before the investment you make in your business can show a return. This is a highly negotiable term in the loan. A longer interest-only period is better. You may also be able to structure this term such that upon achievement of certain milestones, either those related to commitment tranches, or others, result in an automatic extension of the interest-only period.

- Facility Fee – The lower the Facility Fee the better. The fee is payable upon closing the loan, so it has the greatest impact on cost of the loan from a NPV perspective. This is also negotiable and in some cases lenders will waive the Facility Fee altogether

- Final Payment – As per the Facility Fee, the lower the better. If you can trade off a higher Final Payment for a lower Facility Fee it helps the NPV cost of the loan. Many lenders will push out the Facility Fee if you extend the loan or write a second agreement with a greater Commitment Amount until the maturity of the extended or increase loan. The lender wants to keep your business and if the company is experiencing success, doesn’t really want you to repay the loan. They want you to borrow more and for a longer period of time.

- Warrants or Success Fee – The warrants can either be in the form of common stock at the current 409a valuation, or in the form preferred stock at the most recent preferred round. If the preferred has special rights like liquidation preferences, etc., it might be better to have the warrants be common stock warrants despite the lower valuation. If you think there is a potential for very significant value creation during the life of the warrant, you may want to opt for the success fee. The number may look large, but in fact may be a smaller number than the dilution from the warrant.

- Financial Covenants – I always try to remove any financial covenants during negotiation and have been successful in doing so for every loan I have closed. It gets back to the usability of the debt as mentioned with respect to the interest only period. You are borrowing the money to invest in your business. If the funds need to sit on the balance sheet as a cash buffer, it is not helpful. Likewise, if you miss projected revenue you don’t want to have to pay the money back at a point where it would be hard for you to raise an equity round or attract another lender.

I typically do not recommend companies engage investment bankers to help secure Venture Debt. The universe of active life science venture lenders is relatively small and the company’s management team, led by the CFO, should be able to manage the process of identifying lenders and closing a transaction. I recently helped Curevo Vaccine source and negotiate a $27.5M venture loan in August 2022 without any involvement from investment bankers. That experience was guided by these key considerations around terms for the debt.

If your life sciences company needs growth capital and you need advisory support for venture debt, please reach out to me at FLG Partners. Our life sciences team has decades of experience planning and executing transactions fueling growth financing.