By Patrick Nugent

With Highlights from the JP Morgan Healthcare Conference

To understand the current IPO landscape of BioPharma and MedTech, let’s go straight to the data: There were 15 IPOs globally in 2024; 10 in 2023, and 25 in 2022 for MedTech companies.

MedTech IPO activity peaked in 2021 with 61 companies going public. However, for US-only IPOs, there were primarily three MedTech IPOs in 2024 and two each in 2023 and 2022. In 2024, there was mainly one Medical Device IPO of note, CeriBell Inc. [CBLL], which developed a point-of-care EEG system for the acute care setting.

For BioPharma IPOs, there were 73 in 2024, 88 in 2023 and 95 in 2022. However, for US-only IPOs, there were 24 in 2024, 17 in 2023, and 18 in 2022.

Company Profiles of BioPharma and MedTech IPOs

The profiles of companies seeking IPO opportunities in the MedTech and BioPharma sectors differ significantly.

For BioPharma companies, particularly in oncology, early feasibility results were traditionally sometimes sufficient to support an IPO, with the understanding that subsequent funding rounds would depend on the data generated. However, this dynamic has shifted. The current criteria for oncology clinical-stage companies usually now require later-stage clinical trial phases – typically Phase II or later – ensuring that clinical and regulatory risks are minimized at the time of the public offering. In contrast, MedTech companies generally need to be in the commercial growth phase before pursuing an IPO.

The IPO market for MedTech companies has been relatively sluggish over the past three years. To revitalize the market and enhance opportunities for MedTech IPOs, several key factors need to be addressed.

Evaluating IPO Readiness

When evaluating IPO readiness and considerations, several key factors typically come into play, including:

- Company Stage of Development: This includes considerations such as revenue profile, growth trajectory, and risk profile, encompassing clinical and regulatory product phases.

- Market Opportunity: The company must address a large market with significant unmet clinical and medical needs.

- Access to Private Market Funding: Availability of both debt and equity financing in private markets can enable companies to remain private longer, reducing the urgency for an IPO.

- M&A Environment: The market for mergers and acquisitions provides an alternative liquidity option for shareholders.

- Company Valuations: The company’s valuation plays a crucial role in determining proceeding to an IPO, the amount of proceeds that can be raised, and the potential dilution for existing shareholders.

- Economic Environment: Broader factors such as interest rates and economic growth rates can impact the IPO market.

- Experienced Management Team: A seasoned management team is essential for effectively executing the business model and corporate strategy.

- Blue-Chip Investors: The presence of strong, established investors who may contribute significantly to the IPO financing.

Company Stage of Development

The IPO criteria for MedTech and BioPharma companies differ significantly. It is noteworthy that at the annual JP Morgan Healthcare Conference, investment bankers historically report an increasing annual revenue threshold requirement for an IPO for MedTech companies. Unfortunately, this trend reflects the growing requirements driven primarily by the evolving risk tolerance of public market investors.

For MedTech companies, particularly in the Medical Devices and Diagnostics sectors, meeting certain criteria is essential to enable a public offering. The key parameters typically include:

- Revenues: The annual minimum revenue range has fluctuated in recent years, generally falling in the range between $30 million and $50 million.

- Gross Margins: An expected range of 50% to 60%, with a clear roadmap to achieving margins exceeding 70%. However, gross margins can vary significantly depending on factors such as the company’s commercial growth phase, the type of product or service, and the sales model (e.g., direct sales versus distributor-based models).

- Cash Flow Breakeven Point: A consistent revenue growth trajectory, coupled with a clear, actionable plan to reach cash flow breakeven, is essential.

- Product Portfolio: Public investors generally prefer companies with a diversified portfolio of products, rather than those reliant on a single product offering.

When we review as an example one of the MedTech IPOs CeriBell for 2024, you will see the company meets the main criteria as earlier reviewed.

- CeriBell Inc [CBLL] raised approx. $180M in IPO proceeds, at a valuation of approx. $578M – 2023 revenues of $45.2M (outlook for full year 2024 is in the range of $64.2M – $64.7M), gross margins of 85%, and as of the time of this article, the company is up 52% since the public offering in October 2024. This is a recent good example of a MedTech company that executed on the business model, met the criterion, and created the right conditions for a successful IPO

Q&A: Why are there fewer MedTech IPOs?

Q: Is the issue a lack of qualifying companies?

A: We don’t believe this is the case.

Q: Is it a matter of public investors’ appetite for MedTech IPOs?

A: Again, this doesn’t appear to be the primary reason.

Q: Could it be that boards, shareholders, and management teams prefer to remain private longer, given the abundant availability of funding through debt markets and venture capital / private equity for commercial-stage growth companies?

A: This is certainly a contributing factor.

Q: Is it the complexity, reporting requirements, quarterly expectations, and the overall cost of going public?

A: These elements can indeed be deterrents for some companies.

Q: Is the valuation not attractive enough?

A: For some companies, the prospect of liquidity events through M&A transactions may offer more favorable exit opportunities. For example, the 5-year average enterprise value-to-revenue multiple (NTM) for public MedTech companies between 2015-2019 was 5.5x, which has largely recovered to 5.2x by the end of 2023. However, for Life Sciences Tools and Diagnostics, the average multiples during this period was 3.9x, which decreased to 2.7x by the end of 2023. In reviewing with VC’s company valuation is a significant consideration for an IPO in a yes or no-go decision.

Q: Do public investors have concerns about executing to plan?

A: A key consideration for public investors is whether a MedTech company can deliver on its financial forecasts and execute on its business plan.

Q: Is there a fear of missing targets?

A: Missing revenue projections by even a quarter can result in penalties in the form of lower valuations, making potential IPO candidates hesitant to take the risk.

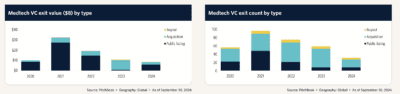

A very helpful chart from Pitchbook research (for the period ending 9/30/24) tells a very definitive picture as to the global exit profile for VCs for MedTech companies. As you will notice, an IPO was a significant avenue for VC exits in terms of exit count and value in 2021, accounting for approx. 50% on the number of exit transactions and 80% in terms of exit value. However, in 2023 IPO exits were virtually nonexistent but finally improving in 2024.

IPO Marketing Gaining Momentum

The IPO market is experiencing a rebound and is expected to continue gaining momentum into 2025. The anticipation is that 2025 will see further growth in public listings, particularly if the strength of the public markets persists. With interest rates stabilizing at lower levels and geopolitical tensions easing, the overall environment is becoming more favorable for dealmaking.

Given the backlog of startups nearing readiness for an IPO, the expectation is in 2025 will be a promising year for public listings. At the most recent JP Morgan Healthcare conference, investment bankers noted there are up to five MedTech companies in the pipeline to go public in 1H 2025.

As company valuations continue to improve, the outlook for MedTech IPOs looks promising. Industry participants have already indicated that CeriBell’s successful IPO could serve as a catalyst for other MedTech startups to explore public listings.