By Eric Mersch

In my experience, many Enterprise SaaS companies struggle with reporting gross margin due to lack of guidance on this topic. FASB refers to gross profit as the difference between revenue and cost of revenue. SEC Regulation S-K provides more detail, defining gross profit as “net sales less costs and expenses associated directly with or allocated to products sold or services rendered.” Compounding the issue is that SaaS gross margin varies significantly from that of other business models such as perpetual software and hybrid hardware/software business models. In this article, I describe the various concepts we use in thinking through the classification of expenses and then go in-depth to evaluate each line item expense as either a Cost of Revenue or Operating Expense.

Gross Margin Concepts

Conducting your gross margin analysis will draw upon several accounting, legal and financial concepts. It is important for you to address each concept during the analysis.

Direct vs. Indirect Costs

It’s important to understand the distinction between direct and indirect costs. A direct cost is any expense associated with service delivery. An indirect cost is any expense associated with the functions required to run the business. You can also think about direct and indirect costs as the expenses associated with the activities that the customer purchases versus those that customers do not purchase. For financial reporting, direct and indirect costs are referred to as cost of revenue and operating expense, respectively. We separate these costs to allow for better understanding of the production costs and margins.

Matching Principle

The second concept is the “matching” principle, which requires companies to report an expense on its income statement in the period in which the related revenues are earned. For our gross margin analysis, we will evaluate activities that add value to the customer in the same period as the revenue is earned versus those activities that add value to the customer in future periods.

Materiality

If the dollar value of an expense is too small to affect decision-making by management, investors, and others, then the specific reporting of this expense may not matter. Materiality is ultimately a judgement assessed by the CFO and will depend upon the dollar value of revenue and expenses. Keep in mind that this expense may grow faster than revenue and become a decision-making factor in the future.

Customer Obligation

Your customer Service Level Agreement, or SLA, establishes the contractual obligation to provide the support activities offered. For example, you may offer customers live 24 by 7 support. To meet this obligation, you will need to staff a team to be on call for inbound customer requests. For this analysis, we will evaluate contractual performance obligations.

Benchmarking

When you complete the GM analysis, it is important to compare your recommended gross margin with that of comparable companies. Any gross margin result outside of the norm is a sign that you should review your analysis more closely.

For this gross margin exercise, we will identify expenses associated with activities that directly support service delivery in the same period as the related revenues and then benchmark your results with those of comparable companies.

Cost of Revenue “Buckets”

For Enterprise SaaS models, direct costs are those activities associated with the delivery of the hosted software. There are seven main “buckets” of expenses:

- Hosting and Infrastructure

- Customer Support

- Professional Services

- Cloud Operations / Platform Support

- Capitalized internal-use software and purchased technology

- Third-party Fees

- Overhead allocations

Let us examine each of the components of cost of revenue to determine the true “direct costs”.

Hosting & Infrastructure Expenses

Subscription software requires a hosting environment that includes (1) servers for processing and storage; (2) internet connectivity; and (3) software that provides security, control, and monitoring services. This is also referred to as the cloud environment.

Your business can manage its own hosting environment internally, but venture-backed companies will use a third-party provider such as Amazon Web Services (AWS), Microsoft Azure or Google Cloud, among a host of others. According to the 2019 Key Banc SaaS Survey, only 12% of surveyed companies operate internal hosting environments.

What makes accounting for third-party Hosting and Infrastructure costs difficult is that your company most likely uses the same provider for R&D as well for service delivery; consequently, the same service provides two separate environments and you will need to identify and separate the costs of the two environments in order to appropriately classify them as “Cost of Service” or “Operating” in nature. The first is a production environment which supports all customer activity on your service in a given period for the revenue generated from those customers in that period and is a direct cost to be booked as Cost of Revenue (COR).

You will also likely deploy a development environment which handles all the internal software development and testing. Engineers use this environment to expand the capabilities of the software running in the production environment. This innovation cost is not required for the current service delivery process. We do expect that this activity will add value to customers in future periods as software updates are put into revenue production. Therefore, expense associated with this activity is indirect and should be booked in operating expense under Research & Development. As CFO, you will need to allocate the amount of the third-party hosting invoice between direct and indirect costs.

Larger companies own and operate their own hosting facilities. Doing so is a complex activity but offers greater control over cloud operations and is usually less expensive at the scale at which these companies operate. Internal hosting operations require additional skillsets. On-site workers maintain the servers, provide security, and run the building maintenance. The company pays directly for the significant amount of energy needed to run the servers as well as networking and interconnection fees. The servers and networking equipment are purchased requiring the booking of depreciation expense. If the company leases all or a portion of the building (this is called a Colocation expense), then ASC 842 lease accounting applies.

Whether the cloud is hosted internally or externally, companies will likely have built proprietary software required to run the company’s platform. Software developed internally should be recorded as prescribed by IAS 38 and amortized when this software is placed into production. Subsequent updates will add to amortization schedules when placed into production. Amortization expense should be included in “Hosting and Infrastructure.”

Companies also employ third-party software for monitoring performance, which is typically referred to as Application Performance Monitoring (APM) and includes providers such as AppDynamics (Cisco); Datadog APM & Distributed Tracking; Microsoft Application Insights; New Relic APM; Splunk Enterprise and IT Service Intelligence; and Stackify Retrace, among many others. These types of software directly support your customer solution and should be classified as Cost of Revenue.

Customer Support versus Customer Success

Customer support is the most widely misinterpreted item because two internal departments – Customer Support and Customer Success – focus on customers and both have Customer in their names.

Customer Support

Customer Support is the on-demand support offering technical assistance. These services will be included in the customer contract, meaning that you need to adequately staff the customer support team to ensure customers can effectively engage with your software. This means that the expense of maintaining an on-demand team should be included in Cost of Revenue regardless of the customer activity volume.

Typical customer calls are related to access issues (“my password doesn’t work”), feature usage (“how do I launch a campaign”) and bug reporting (“hyperlink doesn’t work”). These employee costs are direct since they provide value to the customer in the same period as that of the service.

The customer support team will field questions that require a higher level of technical knowledge. Often, employees from Customer Success and even R&D will be called upon to help. However, this does not mean that associated employee expense related to Customer Success and R&D should be included in Cost of Revenue. If you find that these activities have a low frequency or involve work that crosses several accounting periods, then you should leave this expense in Operating Expense.

However, if your software has significant product gaps that require technical skill for customers to use it, then you probably have engineers engaged in customer work on a routine basis. In case, you should define and consistently classify the associated expense as Cost of Revenue.

Customer support will also require software tools that facilitate communication and support ticket tracking, and this associated expense should be included as well. Popular software tools include Zoho Desk, HubSpot, LiveAgent, Freshdesk, Zendesk, Groove, and Help Scout.

Customer Support payroll and associated expenses should be classified in Cost of Revenue because this activity directly supports the product in the period revenue is earned from the product. Additionally, customer support is likely required to be provided by the customer contract and this adds further evidence for recording as COR.

Customer Success

The Customer Success department provides services that benefit the company by maximizing the value add your software delivers to your customers. Key objectives are to increase customer engagement to ensure that your value add matches the customers’ expectations at the close of the original sale. You will want to ensure that your customers make use of all the services they purchased. If you price your service on a per seat basis, you will want to maximize the number of seat licenses that are in active use. If you use a tiered volume pricing model, you will want your customers to use all the capacity they purchased. In addition, you will want to connect with the end users, who are your customers’ employees or customers, to ensure that these folks fully understand and use all the features available.

Customer Success activities do not generate revenue in the period when customer success activities were performed. Instead, these activities increase the probability of renewal and / or expansion in future periods by maximizing your customers’ satisfaction with your product. Therefore, it is an indirect cost, and indirect cost is an operating cost.

The Customer Success department also plays a key role in defining the product roadmap. The CS team’s activities provide it with the best understanding of customer metrics and, therefore, customer behavior. They see first-hand which features and functionality work and which ones do not. They understand which specific use cases work best, and which frustrate or annoy your customers. The knowledge they build is invaluable to the R&D teams, product marketing, and engineering teams, which will incorporate this knowledge into the product roadmap. In fact, the best performing organizations hold weekly collaboration meetings between the CS and R&D teams to support continual adjustments to the product functionality. One should think of R&D as an investment in future revenue; therefore, associated costs for all activities that drive innovation are indirect and should be included in Operating Expense.

Customer Success teams use many of the same software tools listed in the Customer Support section. There are Customer Success-specific tools available as well. Of these, my personal favorite is Totango, but I also like Monday, Capacity, and AgileCRM. Smaller companies may want to evaluate Krow, a lower cost CS engine.

Customer Success expense should be classified as Operating Expense because it supports revenue indirectly; i.e., it drives customer engagement over several periods, and it helps to inform the product roadmap for future software development.

Customer Support / Customer Success Hybrid Models

Many companies, especially those in early stages, use a single team of people responsible for both customer support and customer success. Even more complicating is that your engineers may field customer inquiries as part of their job responsibilities. Basically, these folks pick up the phone anytime customers call. If this is the case in your company, you will want to allocate associated expenses between Cost of Revenue and Operating using estimates of time spent on customer-facing work.

Professional Services

Enterprise SaaS companies employ a professional services team responsible for onboarding customers. This work involves implementing the SaaS solution and includes technical integration, customization and training. Throughout the contract term, the team provides high-touch troubleshooting and diagnostics, which are the types of specialized service that customer support cannot provide. Some or all of the implementation work may be outsourced to a third-party provider, often known as System Integrators. Cost of professional services revenue include employee compensation costs, travel costs, and costs of outside services associated with augmenting or replacing internal staff.

Cloud Operations and Platform Support Expenses

In general, companies classify activities associated with platform operations and customer support expense as Cost of Revenue since these activities are established to maintain the operational efficiency of the hosted software. Some companies will staff these efforts with cyber-security experts to manage cloud operational security. You may also find regulatory experts working on this team, especially for those companies that need to adhere to the European Union General Data Privacy Regulation, or GDPR.

Capitalized Internal-Use Software and Purchased Technology

We consider computer software that is developed or purchased for the internal usage and needs of the organization as Internal-Use Software. Companies often build proprietary software that directly supports revenue and the amortization of such costs should be included in cost of revenue. Examples include customer billing applications, customization of third-party and open source software, databases customized for the information fields associated with the company’s product, and analytic dashboards that allow customers to monitor usage and customer support to monitor customer health. Third-party software purchased to provide such functionality likewise must be capitalized. Follow the concepts presented in this article to assign capitalization of internal use software to cost of revenue.

Third-party Fees

Many companies have third-party fees such as transaction expenses and external data. Transaction fees are the direct result of a customer activity and should be treated as a direct expense. If your business takes credit cards, then you should account for payment processing fees in cost of revenue under this bucket. Square, Stripe, and Clover, among many others, are examples of payment processors. The transaction fees for such providers should be included in Cost of Revenue.

Some companies use patented software to support their proprietary software. For example, leading public cloud infrastructure providers and ecommerce platforms, such as Heroku and Amazon Web Services, use Twilio’s SendGrid digital communication platform and this expense is incorporated in the former’s Cost of Revenue. Zendesk and HubSpot use Cloudflare’s Content Distribution Network (CDN) for service delivery and include those associated costs in Cost of Revenue.

External data used in the software are direct if needed to provide the software with the full functionality as marketed to the consumer. A cybersecurity leader, Kenna Security, uses third-party subscription data feeds for threat intelligence assessment and books these fees to Cost of Revenue.

Overhead Allocations

We need allocate shared costs, such as facilities costs (including rent, utilities, and depreciation on capital expenditures related to facilities shared by multiple departments), information technology costs, and certain administrative personnel costs to all departments based on headcount and location. As such, allocated shared costs should be reflected in each cost of revenue and operating expenses category.

An Additional Note on Expenses

Before leaving this section, I need to highlight two important notes on Cost of Revenue expenses.

Fully-Loaded Employee Expenses: When recording employee expenses, ensure you include all related expenses – payroll taxes, benefits, bonuses, and stock-based compensation. If the employees travel in the performance of their duties, then include these travel-related expenses.

Overhead Allocation: Most companies allocate overhead, such as applicable shared rent and utilities, to cost of revenues based on some relevant basis of allocation, such as relative headcount. You should incorporate the allocations in line items associated with the salaries and wages in this case.

Benchmarking Gross Margin Recommendations

SaaS Benchmarking Resources

We can use several benchmarking resources to reflect industry best practices in accounting for subscription gross margin for SaaS companies. My four go-to-sources are:

- Key Banc SaaS Survey – Founded by David Spitz, the Key Banc SaaS Survey is a good source of KPIs on venture-backed SaaS companies. Participating companies tend to be on the smaller size with an average ARR in the high single-digit millions. The most recent survey of over 400 companies with a median ARR of $8.7M showed a subscription gross margin of 78%.

- BenchSights – Also founded by David Spitz, BenchSights is a benchmarking platform that helps SaaS sales leaders, and their CEOs, CFOs and Boards, understand the performance of their go-to-market strategies. BenchSights fill a gap in SaaS benchmarking by focusing on enterprise SaaS go-to-market businesses.

- OPEXEngine SaaS benchmark database – OPEXEngine, founded by Lauren Kelley, has the largest database of SaaS companies with the most extensive set of benchmarks in the business. OPEXEngine holds over 200 KPIs, segmented into over 60 different cohorts such as by revenue size, average contract value, growth rates, and more. It is a proprietary database that Lauren built over ten years of working with and providing services to SaaS companies. The gross margin will vary with your company-specific segmentation.

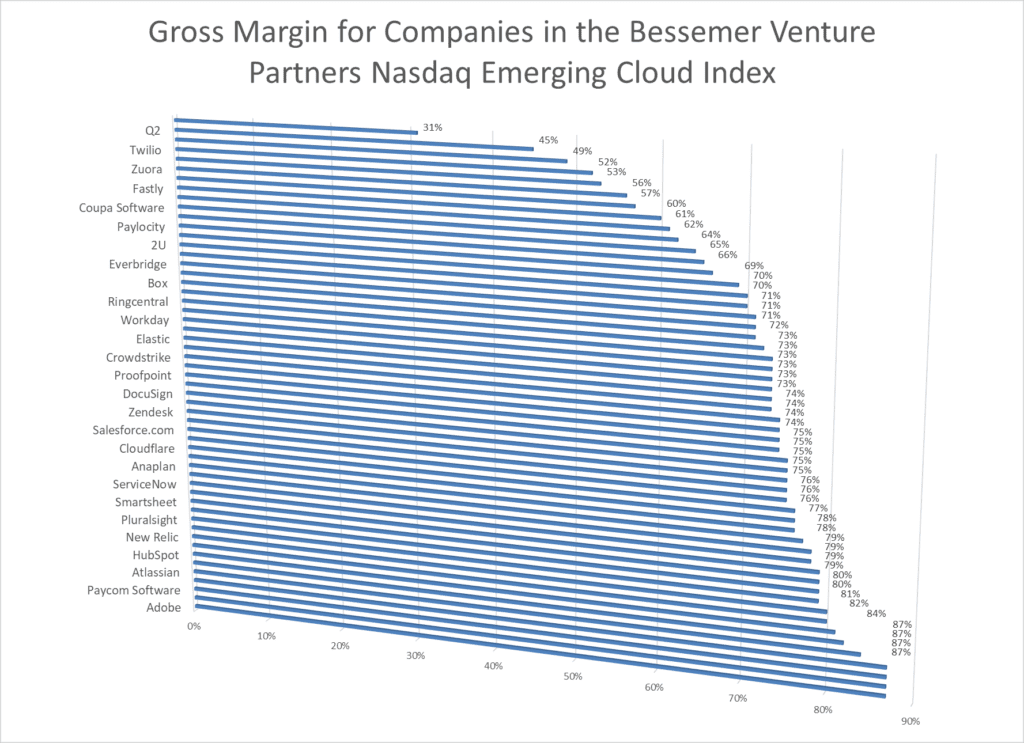

- Publicly traded SaaS companies – For larger SaaS companies, i.e., those with revenues usually above $75M, you will find public comparable company filings valuable. Smaller companies will still find public company filings valuable for forecasting outyears. The SEC website, sec.gov, is the portal for accessing filings of all publicly-held companies. Bessemer Venture Partners (BVP) publishes and maintains an index of public SaaS companies. The BVP Nasdaq Emerging Cloud Index lists 54 companies (as of this writing) along with metrics such as Enterprise Value to Annualized Revenue, Enterprise Value to Forward Revenue, Efficiency (RO40), Revenue Growth Rate, Gross Margin, and Last Twelve Months Free Cash Flow Margin. Also, OPEXEngine offers a platform called EdgarEngine that allows customers to analyze public company comparable data.

A Deeper Dive on Public SaaS Company Data

While the Key Banc Capital Markets and OPEXEngine databases show data in the aggregate, public filings show you company-specific data. Let’s take a closer look at data available to support your gross margin analysis.

Gross Margin Data

The BVP Nasdaq Emerging Cloud Index shows that the mean and median gross margin for these 54 companies is 71.4% and 74%, respectively. You will notice a wide variation in the reporting figures. When using these data for your gross margin analysis, take special care to select the companies that are most comparable to yours.

Cost of Revenue Data

You can also use public filings to identify Cost of Revenue items. I’ve pulled together Cost of Revenue descriptions that show how specific companies present their expenses. As you scroll through the list, you will recognize many of the expenses discussed above as well as expenses that are more common in public companies.

Because public companies are generally larger, many own and operate their own hosting facilities for the reasons mentioned. You will listings of specific costs associated with their operations in the filings.

Summary

While properly allocating and categorizing your various costs may at times seem tedious and unproductive, doing it carefully pays big dividends because you won’t be fooling yourself into thinking your margins are better or worse than your peer group. If your metrics are outliers versus those of your peer group it’s likely that your metrics are either wrong, unsustainable, or indicative of under- or over-investing in your operations. It’s also very valuable at budgeting and forecasting time; forecasts that look too good to be true usually are. Accurate instrumentation of your business should be your North Star as you build and grow.

FLG Partners is expert at helping companies get this right and arrive at a clearer understanding of the complexities of SaaS. Contact us if we can help you navigate your future.

Appendix

10-K Cost of Revenue Extracts

For your reference, I have compiled summaries of Cost of Revenue expenses, which can be found in each company’s 10-K filing under ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (bold emphasis mine).

| HubSpot, Inc. | Cost of subscription revenue consists primarily of managed hosting providers and other third-party service providers, employee-related costs including payroll, benefits and stock-based compensation expense for our customer support team, amortization of capitalized software development costs and acquired technology, and allocated overhead costs, which we define as rent, facilities and costs related to information technology, or IT. |

| Smartsheet | Cost of subscription revenue primarily consists of expenses related to hosting our services and providing support, including third-party hosting fees and payment processing fees, employee-related costs such as salaries, wages, and related benefits, allocated overhead, software and maintenance costs, amortization of acquisition-related intangibles, and costs of Connectors between Smartsheet and third-party applications. |

| Zscaler, Inc. | Cost of revenue includes expenses related to operating our cloud platform in data centers, depreciation of our data center equipment, related overhead costs and the amortization of our capitalized internal-use software. Cost of revenue also includes employee-related costs, including salaries, bonuses, stock-based compensation expense and employee benefit costs associated with our customer support and cloud operations organizations. Cost of revenue also includes overhead costs for facilities, IT, and amortization and depreciation expense. |

| Carbon Black, Inc. | Cost of subscription, license and support revenue consists of hosting costs associated with our cloud‑based offerings, personnel‑related costs for our support and hosting personnel, including salaries, benefits, bonuses, payroll taxes, stock‑based compensation and allocated overhead costs. Also included in cost of subscription, license and support revenue are costs associated with amortization of capitalized software development costs for internal‑use software and amortization of developed technology intangible assets related to our prior acquisitions. |

| DocuSign, Inc. | Cost of Subscription Revenue. Cost of subscription revenue primarily consists of expenses related to hosting our software suite and providing support. These expenses consist of employee-related costs, including salaries, bonuses, benefits, stock-based compensation and other related costs, as well as personnel costs for employees associated with our technical infrastructure and customer support. These expenses also consist of software and maintenance costs, third-party hosting fees, outside services associated with the delivery of our subscription services, amortization expense associated with capitalized internal-use software and acquired intangible assets, credit card processing fees and allocated overhead. We expect our cost of revenue to continue to increase in absolute dollar amounts as we invest in our business. |

| ServiceNow, Inc. | Cost of subscription revenues. Cost of subscription revenues consists primarily of expenses related to hosting our services and providing support to our customers. These expenses are comprised of data center capacity costs, which include colocation costs associated with our data centers as well as interconnectivity between data centers, depreciation related to our infrastructure hardware equipment dedicated for customer use, amortization of intangible assets, expenses associated with software, IT services and support dedicated for customer use, personnel-related costs directly associated with data center operations and customer support, including salaries, benefits, bonuses and stock-based compensation, and allocated overhead. |

| Ringcentral, Inc. | Our cost of software subscriptions revenue primarily consists of fees paid to third-party telecommunications providers, network operations, costs to build out and maintain data centers, including co-location fees for the right to place our servers in data centers owned by third parties, depreciation of servers and equipment, along with related utilities and maintenance costs, personnel costs associated with customer care and support of the functionality of our platform and data center operations, including share-based compensation expenses, and allocated costs of facilities and information technology. We define software subscriptions gross margins as software subscriptions revenue minus the cost of software subscriptions revenue expressed as a percentage of software subscriptions revenue. |

| Mimecast Limited | Cost of revenues consists primarily of costs related to delivering, maintaining, and supporting our cloud-based solutions and delivering our professional services and support. These costs include salaries, benefits, bonuses, and stock-based compensation for our data center and professional services staff, as well as costs of third-party consultants. Cost of revenues also includes expenses associated with our data centers, including networking and related depreciation expense, as well as outside service provider costs, amortization expense associated with acquired and developed technology, and general overhead. We allocate general overhead, such as applicable shared rent and utilities, to cost of revenues based on relative headcount. The costs associated with providing professional services are recognized as such costs are incurred. Over the long term, we believe that cost of revenues as a percentage of total revenues will decrease. |

| Proofpoint, Inc. | Cost of Subscription Revenue. Cost of subscription revenue primarily includes personnel costs, consisting of salaries, benefits, bonuses, and stock-based compensation, for employees who provide support services to our customers and operate our data centers. Other costs include fees paid to contractors who supplement our support and data center personnel; expenses related to the use of third-party data centers in both the United States and internationally; depreciation of data center equipment; amortization of licensing fees and royalties paid for the use of third-party technology; amortization of internally developed intangible assets; and the amortization of intangible assets acquired through business combinations. Growth in subscription revenue generally consumes production resources, requiring us to gradually increase our cost of subscription revenue in absolute dollars as we expand our investment in data center equipment, the third-party data center space required to house this equipment, and the personnel needed to manage this higher level of activity. |

| Veeva Systems Inc. | Cost of subscription services revenues for all of our solutions consists of expenses related to our computing infrastructure provided by third parties, including salesforce.com and Amazon Web Services, personnel related costs associated with hosting our subscription services and providing support, including our data stewards, operating lease expenses associated with computer equipment and software and allocated overhead, amortization expense associated with capitalized internal-use software related to our subscription services and amortization expense associated with purchased intangibles related to our subscription services. Cost of subscription services revenues for Veeva CRM and certain of our multichannel customer relationship management applications includes fees paid to salesforce.com for our use of the Salesforce1 Platform and the associated hosting infrastructure and data center operations that are provided by salesforce.com. We intend to continue to invest additional resources in our subscription services to enhance our product offerings and increase our delivery capacity. We may add or expand computing infrastructure capacity in the future, migrate to new computing infrastructure service providers, and make additional investments in the availability and security of our solutions. |

| Anaplan, Inc. | Cost of subscription revenue primarily consists of costs related to hosting our service. Significant expenses include data center capacity costs, personnel-related costs directly associated with our cloud infrastructure, including total compensation, customer support, equipment depreciation, and amortization of internal-use software. |

| Okta | Cost of Subscription. Cost of subscription primarily consists of expenses related to hosting our services and providing support. These expenses include employee-related costs associated with our cloud-based infrastructure and our customer support organization, third-party hosting fees, software and maintenance costs, outside services associated with the delivery of our subscription services, travel-related costs, amortization expense associated with capitalized internal-use software and acquired technology, and allocated overhead. |

| Elastic N.V. | Cost of subscription – self-managed and SaaS consists primarily of personnel and related costs for employees associated with supporting our subscription arrangements, certain third-party expenses, and amortization of certain intangible and other assets. Personnel and related costs, or personnel costs, comprise cash compensation, benefits and stock-based compensation to employees, costs of third-party contractors, and allocated overhead costs. Third-party expenses consist of cloud infrastructure costs and other expenses directly associated with our customer support. We expect our cost of subscription – self-managed and SaaS to increase in absolute dollars as our subscription revenue increases. |

| Workday, Inc. | Costs of subscription services revenues consist primarily of employee-related expenses related to hosting our applications and providing customer support, the costs of data center capacity, and depreciation of computer equipment and software. |

| Avalara, Inc. | Cost of revenue consists of costs related to providing the Avalara Compliance Cloud and supporting our customers and includes personnel and related expenses, including salaries, benefits, bonuses, and stock-based compensation. In addition, cost of revenue includes direct costs associated with information technology, such as data center and software hosting costs, and tax content maintenance. Cost of revenue also includes allocated costs for certain information technology and facility expenses, along with depreciation of equipment and amortization of intangibles such as acquired technology from acquisitions. We plan to continue to significantly expand our infrastructure and personnel to support our future growth, including through acquisitions, which we expect to result in higher cost of revenue in absolute dollars. |

| Domo, Inc. | Cost of subscription revenue consists primarily of third-party hosting services and data center capacity; salaries, benefits, bonuses and stock-based compensation, or employee-related costs, directly associated with cloud infrastructure and customer support personnel; amortization expense associated with capitalized software development costs; depreciation expense associated with computer equipment and software; certain fees paid to various third parties for the use of their technology and services; and allocated overhead. Allocated overhead includes items such as information technology infrastructure, rent, and certain employee benefit costs. |

| Instructure, Inc. | Cost of subscription and support revenue consists primarily of the costs of our managed hosting provider and other third-party service providers, employee-related costs including payroll, benefits and stock-based compensation expense for our operations and customer support teams, amortization of capitalized software development costs and acquired technology, and allocated overhead costs, which we define as rent, facilities and costs related to information technology, or IT. subscription and support revenue consists primarily of the costs of our managed hosting provider and other third-party service providers, employee-related costs including payroll, benefits and stock-based compensation expense for our operations and customer support teams, amortization of capitalized software development costs and acquired technology, and allocated overhead costs, which we define as rent, facilities and costs related to information technology, or IT. |

| Coupa Software Incorporated | Cost of subscription services consists primarily of expenses related to hosting our service and providing customer support. Significant expenses are comprised of data center capacity costs; personnel and related costs directly associated with our cloud infrastructure and customer support, including salaries, benefits, bonuses and stock-based compensation; allocated overhead; amortization of developed technology and capitalized software development costs. |