By Bob Finley

Over the last two years, a significant number of AI-driven software solutions have entered the market, capable of automating accounting and finance functions to a considerable extent.

New metrics, like “% touchless invoices” in A/P and A/R, new acronyms like “HITL” (human-in-the-loop), “IDP” (intelligent document processing), and “STP” (straight-through processing) have transformed how traditional accounting and finance functions work.

It is now possible to plan and execute a project using an AI-driven framework that can reduce accounting and finance costs by 25% or more.

AI Accounting & Finance Strategy in Practice

Recently, a prospective client asked me to put together a plan that would help meet their CEO’s target of reducing the cost of accounting and finance by 50%. I developed a plan that had ten milestones and over 50 detailed tasks.

Here is a high-level view of how that plan works:

- Discovery – assess the status quo. The first step is to agree on the scope: do you want to focus solely on accounting, or would you also like to include FP&A, Treasury, Tax, Internal Audit, and other related areas? Once the scope is defined, complete a detailed analysis of headcount, fully loaded labor expense, non-labor expense (e.g., software), as well as allocated and secondary costs (e.g., real estate used, IT resources consumed). The results will enable you to rank the functional areas by total cost in descending order. This is your attack plan: it sets you up for some early wins.

- Assess current workflows and documentation. For each functional area (e.g., quote-to-cash, procure-to-pay, etc.), review existing documentation and update it by talking with the actual people who currently perform those tasks. Go through the workflows until every stakeholder says, “Yep, you nailed it. That’s how we do it.”

- HITL (“Human in the Loop”) review. For each workflow, identify every juncture where human intervention is needed and ask why. A good example is Travel and Expense (T&E).At my previous client company, the CEO was responsible for reviewing and approving my airline tickets, hotel costs, and meals.

Why was the chief decision maker and most valuable person in the company doing that?Three reasons: I was an officer (CFO) who reported to him, tradition, and the fear that ambiguous expense policies might allow an invalid expense to be reimbursed. The software vendor

Rippling has determined that one of the primary reasons for human intervention is the presence of ambiguous policies.

Make your policies binary, like computer code. Restructure workflows so that everything gets a green light (approved, continue) or a red light (rejected, returned). What you are looking for is the ability to create a “lights out” accounting workflow where things flow from intelligent document processing to a final outcome like a paid invoice, reimbursed expense, or receivable that is properly applied.

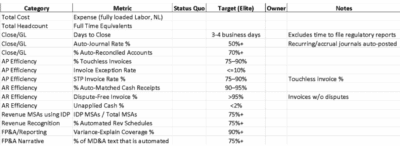

- Develop requirements. Start with your highest-cost areas and establish desired outcomes and metrics. Be aspirational and set stretch goals. Here is an abbreviated example of some sample metrics:

- Review current software stack. You want to understand what software the accounting & finance teams use, as well as what AI functions already exist, and what functions are on the product roadmap. Your software relationship managers are useful sources of this information. Share your aspirational metrics from the previous step with them. How many of these metrics can the software meet today or within the next three months? What you will likely find is that Enterprise Resource Planning (ERP) systems do not have a high degree of AI built in them, so you will need to add purpose-built software, which is the next step.

- Determine future software stack. Based on tasks #4 and #5, you can decide which legacy systems can be upgraded, which new AI-enabled software will need to be integrated into your stack via APIs, and the transition costs. For transition costs, does your company have the in-house expertise to develop APIs or REST APIs? If not, ask for recommendations from colleagues (you may also want to ask this question in your software RFPs).

- Develop new software RFPs. Based on your work so far, especially tasks #4 and #5, use ChatGPT to perform two tasks for you. First, have ChatGPT identify AI-driven software that meets your metrics. Then have it develop RFPs for each new “AI-Bolt on” software. For AI-driven A/P software, some candidates for RFPs could include Basware (they claim 89% touchless invoices), Springtime Technologies (they claim >90% touchless invoices), and HighRadius. For AI-driven A/R software, candidates could include HighRadius, Emagia, Serrala, ACI, Quadient, and Versapay.

- Replacing people with AI. At some point, existing accounting and finance people will start to ask, “If we implement AI broadly, will I still have a job?” This question deserves a great deal of consideration with your Human Resources partners and Corporate Communications teams. Change is inevitable, and having a solid plan in place, whether it involves severance packages or internal growth opportunities elsewhere, will be helpful.

- Calculate ROI. After you have gone live, review your notes from step #1 to see how close you came to meeting your targets. Be careful to measure ROI consistently with how you measured the Status Quo. This is your chance to look like a hero to your CEO and Board Members.

- Post-Implementation Review (4-6 months later). Allow a little time to pass after you have gone live. Then reflect on your actual savings compared to your forecasted savings. Review what went well and where you had some learnings. Then, take the same approach you used to transform accounting and finance and talk to your executive teammates about porting the same approach to Sales & Marketing, Customer Service, and Engineering. Here is an estimate of how AI could reduce your OpEx and expand margins:

AI is Now the Accounting & Finance Baseline

Finally, the secret is out: AI is now the baseline for how accounting and finance functions operate, with the potential to cut costs by 25 to 50 percent, streamline workflows, and eliminate unnecessary human intervention. Achieving this requires more than technology adoption; it calls for a structured plan, disciplined change management, and alignment with corporate goals.

Companies that map their current state, define clear success metrics, and deliberately build AI-enabled finance functions will not only reduce costs but also strengthen resilience, improve decision-making, and free resources for growth. The message is clear: prepare now, because the future of finance will belong to those who harness AI with vision and discipline.