By Cal Hoagland

One of the most common challenges I encounter as a finance executive is assessing the collective finance function within an organization and making strategic recommendations for improvement. This process involves a detailed, structured evaluation of Finance, Accounting/Tax/Treasury, and Investor Relations, ensuring that the right people, processes, and strategies are in place to drive financial success.

I have leveraged this process countless times throughout my career and have discovered with experience that it provides a failsafe by covering all key areas of the finance function. It is the quickest way to evaluate strategy, execution, and current people power.

Step 1: Observe and Assess Team Dynamics

The first step in my assessment process is attending and evaluating strategic and tactical finance meetings. This includes discussions with the Head of Finance and the leaders of each respective department. Key observations include:

- Who Presents and How Often: This provides insight into the basic understanding of leadership roles, communication styles, and which people are delivering the most value.

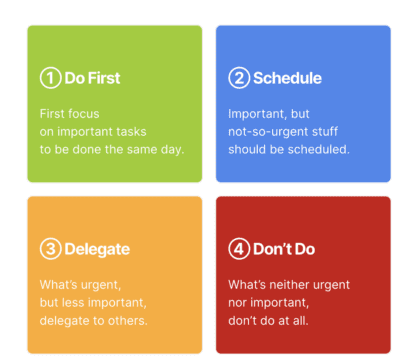

- Meeting Content: Evaluate agenda topics using The Eisenhower Matrix, which helps prioritize tasks by urgency and importance.

- Action Item Management: Discover who is responsible for key items, what needs to be done, how many tasks are outstanding, and due dates.

- People Headcount Evaluation: Assess current vs. needed staffing levels.

- Support Needs: Identify cross-functional and external support requirements.

- Overall Tone and Communication: Gauge the effectiveness and clarity of messaging, as well as the level of respect and collaboration among team members.

Each leader within the finance function undergoes the same structured assessment, ensuring consistency in evaluation across departments.

Step 2: Conduct After-Action Reviews

Following key meetings and decision-making moments, I initiate after-action reports. These reports focus on:

- Timeliness and Transparency: Deliver prompt, candid, and respectful feedback.

- Identify Strengths and Weaknesses: Highlight what went well and what needs improvement.

- Implement Corrective Actions: Encourage a self-regulating approach.

- Enhance Collaboration: Ensure that Finance, Accounting, and Investor Relations function as an integrated unit rather than operating in silos. This might range from 1:1 meetings, regular email updates or Slack channels to consistent touch-point meetings and presentations.

Step 3: Evaluate Leadership and Team Effectiveness

The success of any finance function hinges on the strength of its leadership. To assess each finance function department leader, I examine:

- Resumes and Professional Experience: Ensure alignment with experience and current organizational needs.

- Observational Insights: Evaluate leadership style, decision-making, and adaptability.

- Feedback from Key Stakeholders: Collect input from company executives, managers, peers, auditors, bankers, and investors.

- Critical leadership traits: Assess gravitas, communication effectiveness, proactiveness, timeliness, and collaboration.

Step 4: Review Key Financial Calendars and Reports

Finance functions operate on strict reporting deadlines. I analyze:

- Comprehensive calendars for the whole of Finance and each of its functional areas

- Annual Budget/Plan and Quarterly (in quarter and end of quarter) Forecast Reviews:

- Key observations, variances, and strategic recommendations

- Forecast vs. actual results and estimates for the remaining period

- Required corrective actions to meet financial targets

- Timely Periodic Actual vs. Budget Financial Statements:

- Balance Sheet (BS), Profit & Loss (P&L), Indirect and Direct Cash Flows.

- Board packages, SEC reports, investor reports, and bank lending reports.

Step 5: Assess Internal Controls and Risk Management

To ensure financial integrity and compliance, I evaluate each function’s control environment – not just that of accounting:

- Process flowcharts, checklists, and signoffs

- Documented review and approval processes and signoffs

- Past shortfalls and corrective measures to ensure the control environments are functioning

Step 6: Build a Talent Pipeline

A strong finance function requires top-tier talent. I work with Finance’s functional heads to develop and maintain a network of A-players, leveraging insights from Who: The A Method for Hiring by Geoff Smart and Randy Street. This ensures a continuous flow of high-caliber professionals ready to step into critical roles.

Step 7: Assess Collaboration, Systems, and Continuous Improvement

For the finance function to operate optimally, I assess:

- Collaboration: Are Finance teams’ function leaders “joined at the hip” on key decisions? They should be.

- Key Processes and Risk Areas: Identify vulnerabilities and inefficiencies.

- Industry and internal metrics: Benchmark against best practices.

- Systems and technology: Evaluate ERP, reporting, and analytics tools.

- Continuous improvement methodologies: Implement trend analysis, after-action reports, and process optimizations.

Step 8: Make Strategic Recommendations

The final step is compiling and presenting a set of recommendations, along with the costs and timelines for implementation. These recommendations focus on:

- Leadership development and restructuring

- Enhancing financial reporting accuracy and timeliness

- Improving cross-functional collaboration and communication

- Upgrading financial systems and processes

- Strengthening risk management and compliance measures

Art and Science

Companies and teams working with people and processes are, in reality, and as they should be, a blend of both art and science. However, when the assessment is structured this way, evaluation and assessment of existing finance functions can be more objective, providing clear action items, goals, and solution-oriented results. In this way, organizations can ensure that their finance function is optimized for strategic execution. Only a top-performing, well-integrated, highly- (and effectively-) communicative finance team can drive long-term business success.