By Patrick Nugent

This article is first in a 4-part series reviewing financing solutions for the Life Science sector.

As we move into Q2 of 2024, the Fed continues to hold the line on interest rate declines. Capital markets remain tight and for companies in need of growth financing, this is problematic. This can be especially tricky when it comes to pre-revenue life sciences companies who need to finance spending over the course of a longer runway.

FLG Partners consults with many clients in just these situations so we wanted to take a look at the most recent reviews of trends in Life Science funding. Here is what the latest data shows:

Life Science Funds Are Flush with Dry Powder

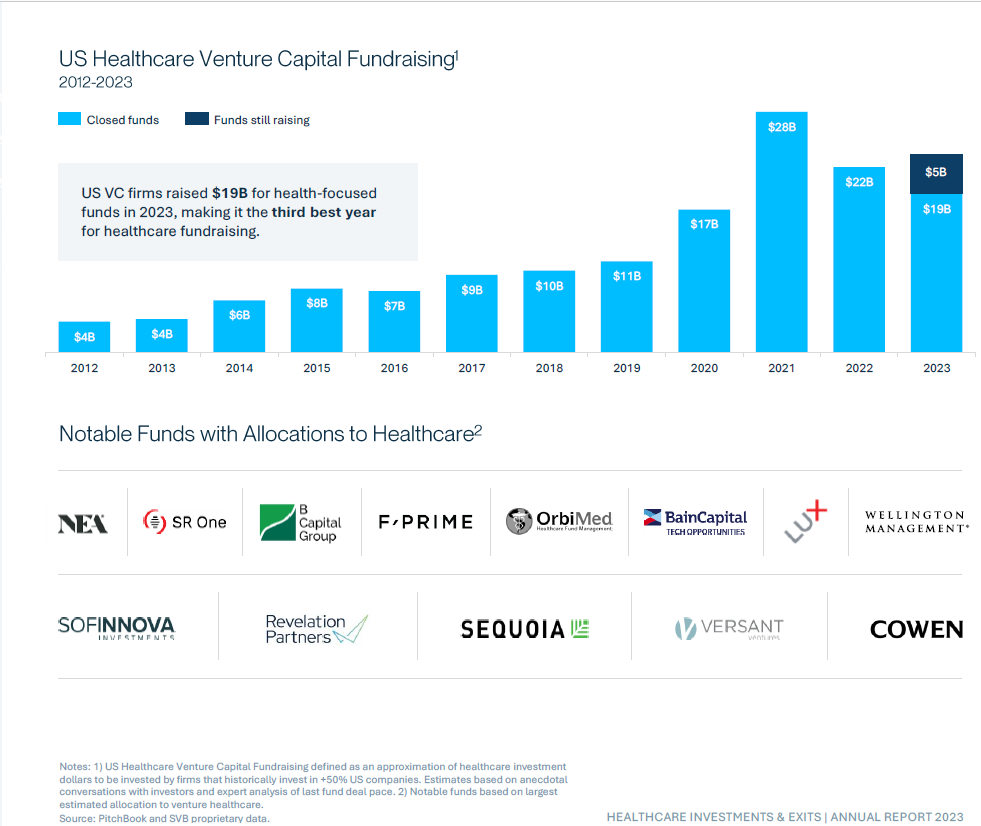

In 2023, US Healthcare Venture Capital Investors raised $19B for health focused funds, their third best year in fund raising. Additionally, in 2023 an even stronger level ($43B) was raised by healthcare companies. Almost half (52%) went to late-stage companies with the balance (36%) going to early-stage companies and 12% to growth companies. This bodes well for the sector overall and lends credence to the prediction that there is lots of dry powder among investors for life science companies to take advantage of in the near term.

In Life Science Deals Meet the “Have’s” and the “Have Nots”

Perhaps not surprisingly, a significant percentage of private placements in 2023 (almost 50%) went to preclinical stage biotechs where the fundamentals are strong, and investors feel more confident about their prospects.

Life Science Company Valuations are Finally Rebounding

While valuations for private companies peaked in Q4 2021, company valuations continued to fall till about 1H 2023. But in the last two quarters of 2023, there has been a positive trend in valuations which are now recovering and are rebounding.

But Fundraising is Taking Longer

Investors, however, appear to be increasingly choosey about where they decide to place their investments and are taking longer to complete due diligence. In the past, private rounds of financing would take anywhere from 3 – 4 months to complete but now it takes closer to 6+ months to secure a lead. Fund raising is consequently taking longer. The average time since a company’s last equity round grew from an average 1.4 years in Q1 2022 to 2.1 years in Q4 2023.

Cash Continues to Be “King”

As of the end of 2023, 43% of US listed biotech companies had a market cap of over $100M; 36% of these companies had less than one year of cash on hand. Cash management has become paramount as the period of high interest rates and tight capital markets has grown longer than many companies originally anticipated. The data also shows that there are an increased number of internal investor bridge financings occurring among life sciences companies, allowing them to fund operations while they drive to their next value inflection point prior to securing another equity raise.

Public Company Multiples are Recovering (Medtech)

For public companies the 5-year average multiples (defined as Enterprise Value divided by next twelve months revenues NTM) for the period 2015 – 2019 was 5.5 times for Medtech and is now 5.2 times so mostly recovered. However, for Life Sciences Tools and Diagnostics the average was 3.9 times and is now 2.7 times.

For additional FLG Partner commentary about trends in financing for Life Sciences companies, please watch our Panel Roundtable hosted in 2024.

Sources:

- Deloitte: “New Strategies for Medtech Startups”, 2021.

- CItigroup Global Markets “2023 Review and 2024 Outlook” December 2023.

- Silicon Valley Bank “Healthcare Investments and Exits: Annual Report 2023”, January 2024.