By Eric Mersch

Summary

In a growing trend, companies increasingly seek to educate their employees on financial reporting and incorporate an understanding of financial metrics into the company’s culture. Over the past twenty some years, the adoption of systems and collection of internal data generated within companies has grown exponentially. Today more than ever, companies use data on business activities – customer behavior, end-user engagement, product innovation, monetization strategies, and internal process flows – to drive decision making. The Chief Financial Officer’s job is to connect this operational data to business performance and thereby improve financial reporting. The stronger the data-driven culture, the better the business performance. In this article we will provide you with the basics of financial reporting and review the financial profile for SaaS companies.

Best Practice Financial Reporting Methodologies

The primary basis for presentation of financial reports is governed by a set of accounting rules referred to as the Generally Accepted Accounting Principles, or GAAP. GAAP defines the way in which the accounting recognizes the company’s revenue and costs, assets and liabilities, and the equity in the business.

In addition to GAAP, investors and creditors expect to see three types of financial statements, which are:

- Income Statement, also called Statement of Operations and Profit and Loss Statement

- Balance Sheet

- Cash Flow Statement

In this article, we will discuss these statements, show best practice for reporting and define the major terms included in each. Then, as sort of a practical exercise, we will review SaaS company financial reports and highlight the specific financial profile associated with these businesses. For reference on specific terms during your reading, please see our SaaS Glossary.

Financial Statements

Income Statement

As mentioned above, the Income Statement is also called a Statement of Operations in public company reporting. Smaller companies may just call it a Profit and Loss statement. The main function of the income statement is to show the revenue and costs for a specific period and the resulting profit or loss from business operations.

Best practice for income statement format is what’s known as a “Two-Step” format, in that revenue and costs are organized into categories to provide for better decision making. The use of a standard format also allows for benchmarking, or the practice of comparing performance of different companies.

Revenue: The income statement starts with revenue, which is the income earned from operating the business. For SaaS companies, revenue is subdivided into recurring software, recurring service, and non-recurring categories. Recurring software revenues are subscription revenues from the delivery of a cloud-hosted product. Recurring service revenue is generated by maintenance and support contracts. Non-recurring revenues are typically derived from professional services work for the on boarding of new customers and includes activities such as implementation, system integration, and end user enablement.

Cost of Revenue (COR) – Termed Cost of Goods Sold (COGS) in companies that sell hardware or physical products, COR represents the costs associated with the delivery of the hosted software product. Such costs are known as direct costs because they are incurred by directly providing the product in the period when the revenue is earned. Direct costs for SaaS companies include (1) hosting and infrastructure; (2) customer support; (3) Cloud Operations / Platform Support; and (4) third-party software and data fees.

The net of Revenue and Cost of Revenue is Gross Profit, and Gross Margin is Gross Profit as a percent of Revenue. Gross Margin is covered extensively in this article: Calculating Gross Margin for Enterprise SaaS Businesses.

Operating Expense – Operating expense represents the costs associated with engineering and product development, sales customer success, marketing and business development, and administrative functions required to support the business. SaaS companies typically use three cost centers, or categories, for financial reporting. These are:

- Research & Development – The people and systems expense associated with engineering and product development activities

- Sales & Marketing – The people and systems expense associated with sales, customer success, and marketing activities. Discretionary marketing expense, usually for digital marketing, is included in this category. Sales commissions, although based on new customers, should be included here as well.

- General & Administrative – These costs are associated with the people – employees, contractors, and vendors – who manage finance, accounting, legal human resource and facilities.

Operating Income – Operating Income is defined as Gross Profit less Operating Expense.

Net Income – Net Income equals Operating Income less expenses such as interest received on cash holdings net of interest paid on debt. These are called non-operating expenses because they are not related to the core activities of the business. One-time gains and losses from the sale of assets are included in non-operating expenses.

Balance Sheet

The Balance Sheet is a snapshot of the company’s assets and liabilities at a specific point in time. Finance produces a balance sheet for the end of the month. For purposes of this discussion, the main Balance Sheet terms are Assets, Liabilities, and Equity.

Assets are simply the company’s cash, money due from customers (formally, the company’s accounts receivable), prepaid expenses; e.g., payments for future events such as marketing shows or professional services paid in advance.

Liabilities mainly represents the money that the company owes to vendors and suppliers, formally accounts payable, and deferred revenue. The deferred revenue balance is material in enterprise SaaS companies because these companies receive upfront payments for software delivery in future periods. The greater the upfront payments the higher the deferred revenue balance. Therefore, deferred revenue is an indication of future business performance, especially when tracked over time.

Equity is the value of the company after liabilities are subtracted. This account keeps track of venture investments as well as the operating gains or losses from the core business. Most venture capital companies have negative equity values because they consume cash as they grow. We will review cash flow in the next section.

One final important lesson is that the company’s Assets will always equal the sum of Liabilities and Equity. This principle is known as the Accounting Equation.

Cash Flow Statement

The cash flow statement is easy to understand because it is simply the net of cash received and cash paid out by the business. It is the difference between two balance sheets over time. There are three components to the Cash Flow Statement:

- Cash flow due to Operating Activities

- Cash flow due to Investing Activities

- Cash flow due to Financing Activities

Cash flow due to Operating Activities – For our discussion, this is the most important category. Operating Activities refer to the cash flow generated or consumed by the core business. The main component here is Working Capital, which we define as the money required to run the business. Working Capital amounts arise as companies incur operating expenses to drive future revenue. In other words, the company needs investment in the current period to acquire customers and generate cash receipts in future periods. Enterprise SaaS companies typically have negative Working Capital, which is a good thing. The negative term means that upfront payments actually fund some portion of the business.

Cash flow due to Investing Activities – This cash flow category is defined as money spent to acquire hardware to support customers and employees. Companies that build and operate their own data centers will have large investments. Most SaaS companies today use third party data centers such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, and Oracle Cloud; these are operating expenses. So, the only cash flow items from investing activities for these companies are employee laptops, networking equipment, and office furniture.

Cash flow due to Financing Activities – These are cash flows from equity investments and assumption of debt. Venture investments are equity. Bank loans are debt.

The main point of this section is that the sum of cash flow from operating activities and investing activities is the company’s Free Cash Flow, or FCF. Free Cash Flow is the total cash used or generated by the company’s core business activities net of capital expenditures (CapEx). When private companies report their Burn, or Burn Rate, they are referring to the company’s Free Cash Flow. Venture-backed companies almost always have negative Free Cash Flow because they are using investments to build and deploy products into new markets on the bet that they can emerge as a profitable market leader.

One important point on Free Cash Flow is that Operating Income is not a proxy for Free Cash Flow because all contracts require upfront payments. While Subscription Revenue is amortized over twelve-months, the Bookings amount is collected upfront, albeit with some collections delay.

Theoretical Enterprise SaaS Financial Profile

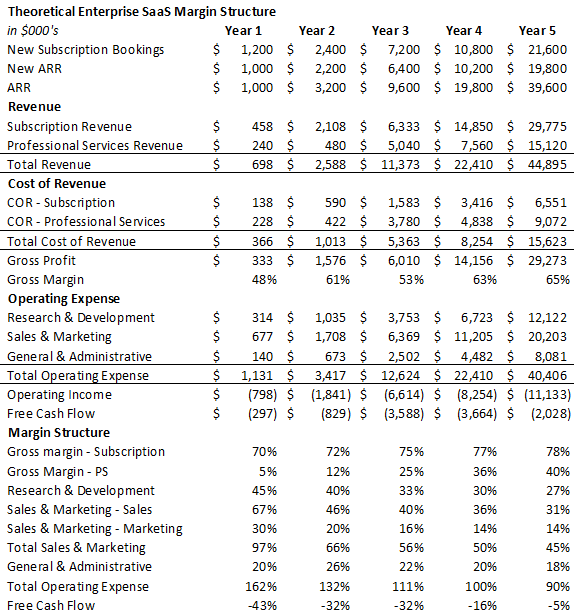

With this knowledge, let’s review a theoretical Enterprise SaaS model for the first five years of operating starting with the first year of revenue. We’ll keep this exercise high level largely to demonstrate the margin structure as it matures.

First, we start with ARR growth. We model ARR growth using the T2D3 rule of thumb, which defines best-in-class growth as two years of tripling revenue, i.e., “T2”, followed by three years of doubling revenue, i.e., “D3”. New ARR is added consistently over the 12 month period and converts to revenue one-twelfth per month according to its monthly cohort. Subscription Revenue is amortized monthly over twelve months and will always lag ARR as a result. The variance will shrink by a diminishing margin as the company grows its ARR base. The company’s ability to monetize Professional Services is limited, as shown by low revenue and high direct costs in the early years, but grows quickly with experience and implementation toolkits. Operating expenses grow with the company but the ratios of R&D, S&M and G&A to Total Operating Expense stay nearly constant at 0.3, 0.5, and 0.2, respectively. Sales expense consistently makes up 70% of the S&M budget. Sales Efficiency stays above 1.0x at this growth rate, representing perfect execution. Free Cash Flow benefits from upfront annual payments adjusted downward for collections delay. Subscription Bookings Non-Recurring Bookings are assumed to be collected in the same period to make the analysis simpler.

To reiterate, this is a purely theoretical exercise showing an Enterprise SaaS company with high growth and perfect operational execution. Still, this exercise is valuable because it’s based on my CFO experience working with venture-backed companies as well as my research on these types of business models.

Understanding this theoretical financial profile will give you the basis for evaluating Enterprise SaaS companies.